In addition to its hospitalization coverage, Medicare Part A also includes coverage for skilled nursing and short-term home health care after a hospital stay, as long as it is deemed medically necessary. Part A also covers hospice services, which may involve palliative care, counseling, social services, and durable medical equipment. Furthermore, Medicare hospice coverage offers temporary respite care for caregivers to take a break.

In addition to its hospitalization coverage, Medicare Part A also includes coverage for skilled nursing and short-term home health care after a hospital stay, as long as it is deemed medically necessary. Part A also covers hospice services, which may involve palliative care, counseling, social services, and durable medical equipment. Furthermore, Medicare hospice coverage offers temporary respite care for caregivers to take a break.

Moreover, Part A provides certain home health care services that can be received in the hospital or immediately after an inpatient stay. These services encompass skilled nursing care, medical social services, and physical therapy. However, coverage for home health aide services is typically contingent upon the presence of skilled nursing care.

It is important to note that Medicare does not cover long-term care, such as extended stays in a nursing home. Individuals who wish to plan for long-term care can explore the option of purchasing long-term care insurance.

Medicare Part A Hospital Coverage - What is covered?

Covered for Inpatient Stays

There are instances where certain items, which one might assume fall under Part A, actually fall under Part B, like outpatient surgeries. To ascertain whether a service is categorized as inpatient or outpatient, it is advisable to seek guidance from your Medicare insurance broker. Nevertheless, in most cases, Part A covers hospital-related expenses that are essential for immediate or acute care of an injury or illness.

How Much is Medicare Part A Cost?

Most individuals who are 65 years old and eligible for Medicare Part A will not have to pay anything for it, thanks to the fact that they have already made pre-payments. This is because throughout our working years, we contribute taxes that are specifically allocated for our future Medicare hospital coverage during retirement. These taxes help to offset the expenses associated with Part A when the time comes.

If you have worked for a minimum of 10 years in the United States, you will generally be exempt from any payment for Part A. However, if you do not meet this work history requirement, you still have the option to purchase Part A as long as you have been a legal resident or green card holder for at least 5 years. For more detailed information regarding the cost of Part A, please refer to our Medicare costs page.

In the event that you do not have 40 quarters of coverage, you can still obtain Part A by paying premiums. In 2024, the premiums are set at $505 for individuals with less than 30 quarters, and $278 for those with 30 to 39 quarters.

When do I enroll in Medicare Part A?

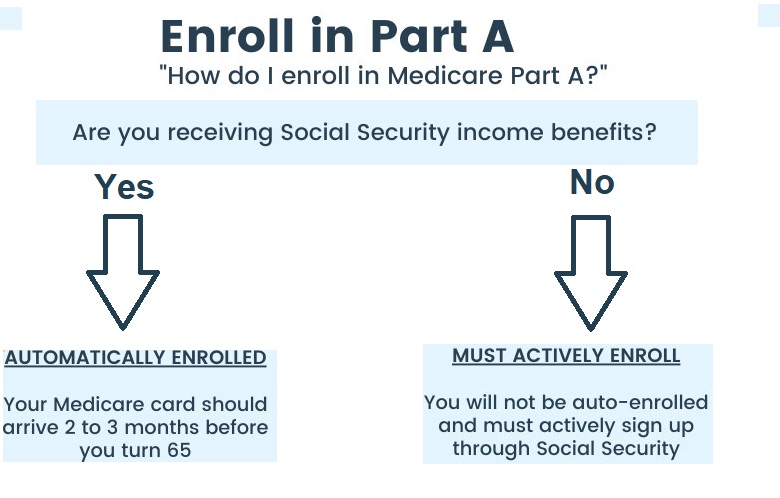

Enrollment in Medicare Part A is automatic for individuals who are already receiving Social Security income benefits. Prior to turning 65, you can expect to receive your Medicare card in the mail approximately 2 – 3 months in advance. It is important to keep an eye on your mailbox for this card. The card itself is printed on durable card stock and features a red, white, and blue design. Upon receiving it, you may choose to laminate the card to ensure its longevity while being stored in your wallet or purse.

If you are not currently receiving Social Security income benefits or Railroad Retirement income benefits, it is necessary for you to actively enroll in Part A once you reach the age of 65. This can be done conveniently through the Social Security website.

What is my Medicare Cost-sharing under Part A?

Your Medicare Part A coverage offers extensive benefits, but it is important to note that there are certain cost-sharing responsibilities as well. Each year, the Centers for Medicare and Medicaid Services (CMS) determines the deductible and coinsurance amounts that you will be accountable for in the following year. These cost-sharing amounts apply when you utilize your Part A benefits. For the year 2024, the following payments will be required:

1. A deductible of $1,632 for each inpatient hospital stay if you have not been hospitalized in the previous 60 days.

2. $408 per day for days 61 to 90 of a consecutive hospital stay.

3. $800 per day for days 91 to 150 of a consecutive hospital stay.

4. Any costs incurred beyond your lifetime reserve days.

Please be aware of these cost-sharing obligations associated with your Medicare Part A coverage.

What are lifetime reserve days?

Without a Medigap plan, Medicare Part A provides you with 60 lifetime reserve days. These reserve days come into play when you have a hospital stay that exceeds 90 consecutive days. For instance, if your hospital stay lasts for 100 consecutive days, you will have utilized 10 of your lifetime reserve days. If you happen to have another hospital stay the following year, lasting for 120 consecutive days, you will have utilized a total of 30 (10 + 20) of your lifetime reserve days. Once you exhaust all of your lifetime reserve days, you will be responsible for covering all Part A costs starting from day 91 for any hospital stay that exceeds 90 days.

Skilled-nursing facility costs

Medicare provides coverage for the first 20 days of skilled nursing facility stays. From days 21 to 100 in 2024, you will be responsible for a daily copay of $204. The good news is that both Medigap policies and Part C Advantage plans can assist in covering these expenses. Whether you choose either type of plan, it will greatly minimize your financial burden.

Common questions asked about Medicare Part A:

How do I enroll in Medicare Part A only?

If you possess creditable coverage, it is possible to postpone enrolling in Medicare beyond the age of 65. Nevertheless, numerous individuals opt to enroll in Part A to obtain supplementary hospital coverage. The application for Part A can solely be submitted via the Social Security Administration website.

What is the difference between Medicare Part A and Part B?

Medicare Part A is inpatient hospital coverage, while Part B covers outpatient medical services.

How much is Medicare Part A?

Individuals who have worked in the United States for a minimum of 10 years may be eligible for a Part A plan with no monthly premium. Nevertheless, if you do not meet the criteria for premium-free Part A, you may be required to pay up to $505 for this coverage.

Takeaways

Medicare Part A provides coverage for your inpatient room and board, daily meals, hospice care, skilled nursing, and home health care. The majority of individuals are eligible for premium-free Part A, although some may have to pay a premium if they have not worked in the U.S. for a minimum of 10 years. However, it is important to note that before Medicare Part A can assist in covering most of your expenses, you must first meet the Part A deductible.

Mario Arce

Mario Arce

I have been working with Medicare clients since 2016. I serve California members in San Bernardino & Riverside county.