What is a Medicare PFFS plan?

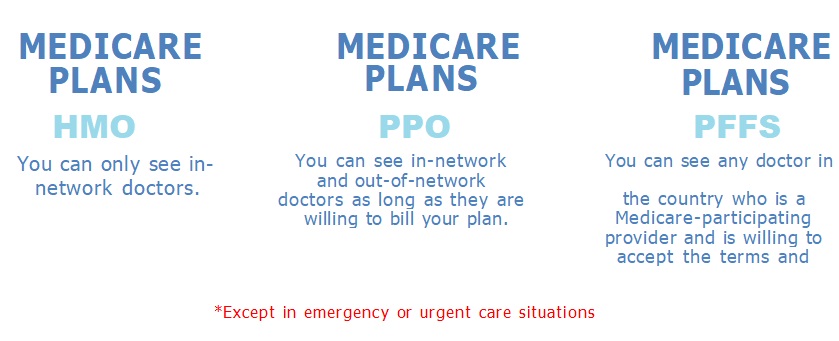

A Private-Fee-for-Service (PFFS) plan is a unique type of Medicare Advantage plan that is offered in specific regions. When enrolling in a Medicare PFFS plan, you are responsible for paying the plan’s premiums, along with any co-pays and coinsurance for the medical services covered by the plan. Unlike HMOs or PPOs, PFFS plans do not restrict you to a specific network of healthcare providers.

Instead, prior to seeking medical care, you are required to present your Medicare PFFS plan ID card to any healthcare provider. The provider must agree to accept the plan’s payment terms and conditions and bill the plan before they can treat you.

There are two notable features of Medicare PFFS plans:

1. You have the flexibility to present your card to any Medicare-participating provider in the United States and inquire if they will provide treatment. This makes Medicare PFFS plans popular among Medicare recipients who frequently travel.

2. Some Medicare PFFS plans offer the option to have a separate Part D drug plan. You can choose a PFFS plan that includes a built-in drug plan or opt for a “medical only” PFFS plan and enroll in a separate drug plan.

It is crucial to understand that PFFS plans should not be confused with Medicare Supplement insurance. Providers who do not have a contract with the plan are not obligated to treat you, except in emergency situations. Therefore, it is your responsibility to communicate with healthcare providers and ensure they agree to see you and bill the plan.

Takeaways

PFFS plans require you to cover the plan’s premiums, copays, and coinsurance. You have the flexibility to choose any healthcare provider who is willing to accept the payment terms and conditions of your plan. It’s important to note that Medicare PFFS plans are categorized as Medicare Advantage plans, not Medicare Supplements.

Mario Arce

Mario Arce

I have been working with Medicare clients since 2016. I serve California members in San Bernardino & Riverside county.