Medicare Advantage plans, approved by Medicare, are private health insurance options that offer Part A, B, and D benefits. Instead of traditional Medicare, individuals have the choice to receive their coverage through a Medicare Advantage plan, which typically includes an HMO or PPO network of healthcare providers.

Medicare Advantage plans, approved by Medicare, are private health insurance options that offer Part A, B, and D benefits. Instead of traditional Medicare, individuals have the choice to receive their coverage through a Medicare Advantage plan, which typically includes an HMO or PPO network of healthcare providers.

Medicare Advantage plans offer an alternative to Original Medicare and Medigap by allowing you to receive all your Part A & B services through a single plan. By enrolling in an Advantage plan, Medicare will pay the plan a fixed monthly amount for your care, while the plan takes on all your medical risks. It is important to note that you still need to pay your Medicare Part B premium while enrolled in an Advantage plan, and you must be enrolled in both Medicare Parts A and B and reside in the plan’s service area.

Medicare Advantage Coverage

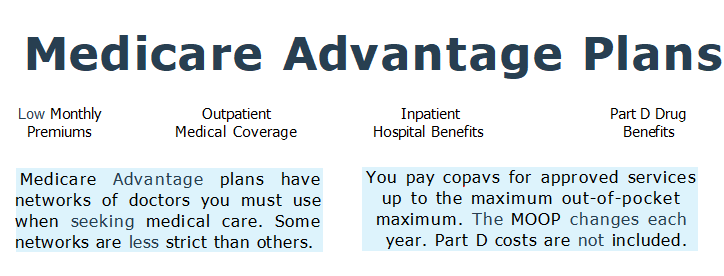

Many individuals who are new to Medicare often ask about the advantages and disadvantages of Medicare Advantage plans compared to Original Medicare. The manner in which you access your benefits largely determines the answer to this question. Under Original Medicare, you will be responsible for deductibles and a 20% coinsurance on Part B. You have the freedom to visit any healthcare provider or hospital that participates in Medicare, which is the majority. On the other hand, with an Advantage plan, you will utilize the plan’s network of providers. When receiving healthcare services, you will be required to make co-payments. Each plan has its own cost-sharing structure. For instance, you may have a small copay for a visit to a primary care doctor and a higher copay for a specialist. Additionally, certain plans may charge a daily hospital copay, while others may charge a fixed amount for the entire duration of your stay.

One of the major distinctions lies in the modifications made to the plans. While Medicare may introduce minor alterations to the Part A and B deductible, the coverage of 20% for outpatient services remains constant. On the other hand, Part C Medicare Advantage plans undergo annual changes.

According to Medicare itself, there may be limitations, co-payments, and restrictions that could be applicable, and the benefits, formulary, pharmacy network, provider network, premium, and co-payments of each plan may change every January 1. It is crucial for members to diligently review the plan materials sent to them each September to stay informed about any changes.

The Creation of Medicare Advantage

For years, individuals covered by Medicare were limited to only choosing Medigap plans. Although these plans offer comprehensive coverage, they are not always affordable for everyone. As a result, some individuals opted to stick with Original Medicare only. Unfortunately, when faced with unexpected illnesses, they found themselves burdened with costly deductibles and coinsurance that were beyond their means.

In such situations, individuals may attempt to switch to a Medigap plan. However, due to their newly developed health issues, they may no longer qualify for coverage. This often led to financial hardship and even medical bankruptcy.

Fortunately, Medicare Part C plans have emerged as a solution to these challenges. These plans offer more affordable options without requiring individuals to answer health questions. Eligible individuals can now enroll in these plans during specific enrollment periods throughout the year.

Advantage plans were designed to include a maximum limit on your medical expenses, providing a safety net for your healthcare costs. If you reach a certain out-of-pocket limit due to significant health spending, the plan will take over and cover the remaining expenses for the rest of the year (excluding Part D expenses, which are calculated separately).

Additionally, Advantage plans commonly offer more convenient benefit features, including Part D drug plan, eliminating the need for a separate purchase.

Medicare Part C = Medicare Advantage

Medicare Advantage plans, also known as Part C of Medicare, were established through the Balanced Budget Act of 1997 and were officially enacted by President Bill Clinton. In certain medical practices, they are referred to as replacement plans. Further details on this matter will be discussed below.

Congress established this program with the intention of providing Medicare beneficiaries with an alternative option that has lower premiums compared to Medigap. These plans serve as a coverage choice for individuals who missed their open enrollment period for Medigap and are now unable to qualify for it due to health conditions.

Medicare Advantage plans, also referred to as MA, differ from Medigap plans. Instead of receiving benefits from Original Medicare, members obtain their benefits from a private insurance company. It is important to note that these plans are sometimes inaccurately labeled as Medicare replacement insurance, a term that Medicare does not endorse. Joining a Medicare plan does not permanently replace your Medicare coverage; rather, it means that you have opted to receive your benefits from a private company for the remainder of the calendar year. If eligible, you can always switch back to Original Medicare during a valid election period.

How it Works

A Medicare Advantage plan serves as a private Medicare insurance option that allows you to receive your Part A and B benefits in an alternative manner. In this arrangement, Medicare provides a monthly fee to the plan in order to administer your Part A and B benefits.

While you are enrolled in a Medicare Advantage plan, it is essential to remain enrolled in Medicare Part A and B. Medicare pays the Advantage plan company on your behalf to assume your medical risk, which is the primary source of funding for Medicare Advantage plans.

When seeking treatment, you will need to present your Advantage plan ID card. Instead of billing Original Medicare, your healthcare providers will bill the plan directly. This is why some providers refer to these plans as Medicare replacement plans. However, it is crucial to remember that you always have the option to return to Original Medicare during a future annual election period.

Basic Advantage Rules

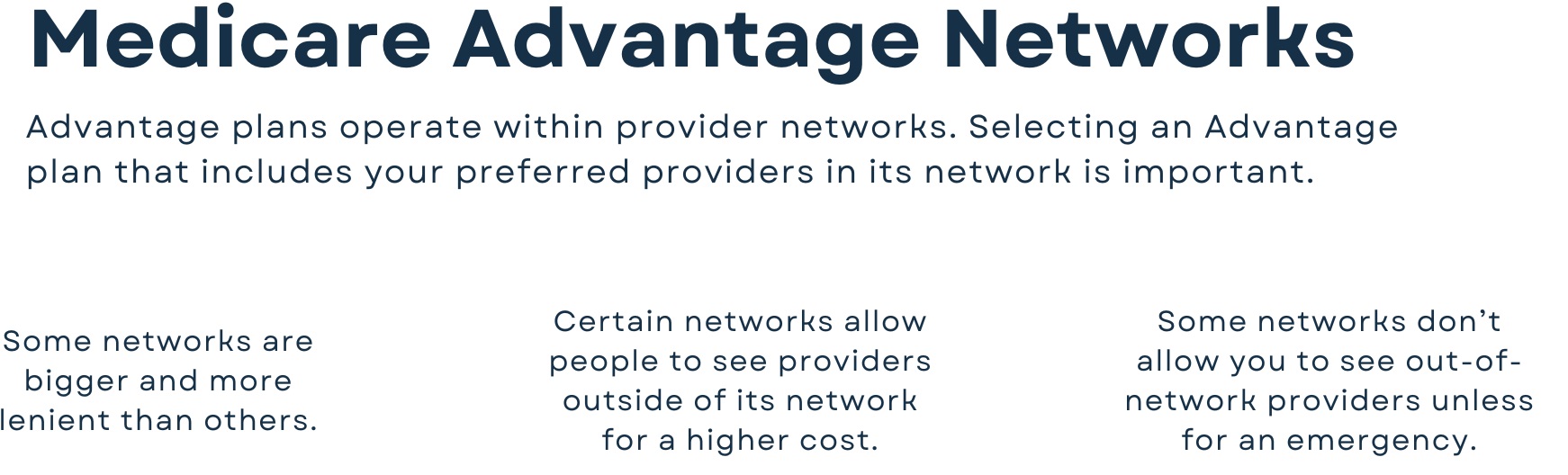

When choosing between Medicare Advantage and Medigap, it is important to take into account certain regulations before enrolling. To be eligible, you must be enrolled in Medicare Part A & B and reside within the plan’s service area. It is a common misconception that you can drop Part B if you opt for Medicare Advantage, but this is not the case. Dropping Part B while enrolled will lead to immediate disenrollment from your Medicare Advantage plan. Make sure to utilize network doctors and hospitals to minimize out-of-pocket costs. Plans typically have HMO or PPO networks, with Medicare HMO plans usually not covering anything out of network except for emergencies. In PPO networks, seeking care outside the network will result in higher expenses for you. Keep in mind that Advantage plans may require prior authorization for specific procedures, and you may need a referral from your primary care physician before seeing a specialist on many HMO plans. Safeguard your red, white, and blue Medicare card and do not provide it to healthcare providers. If they bill Medicare, the claims will be rejected as they should have been sent to your Medicare Advantage insurance company for processing. Remember to instruct your providers to bill your Medicare Advantage plan, as enrolling in Advantage plans means agreeing to be covered by the plan instead of Original Medicare for the remainder of the calendar year.

Takeaways

1. Despite enrolling in an Advantage plan, you will still be required to pay a premium for Part B coverage.

2. It is important to note that Advantage plans operate differently from Medigap plans, therefore it is crucial to fully comprehend the variances between the two prior to enrolling in an Advantage plan.

3. While Advantage plans may provide extra benefits not covered by Original Medicare, it is essential to be aware that these benefits can be altered annually.

Mario Arce

Mario Arce

I have been working with Medicare clients since 2016. I serve California members in San Bernardino & Riverside county.